Foreign Firms Endorse Industries with the Highest Concentration of Science, Engineering, and Technician Occupations

SelectUSA emphasizes that high-tech industries accounted for nearly a quarter of the total US economic output in 2016. FDI plays a significant role, making up for about 10% of the total value added to the US economy in the high-tech sector. The FDI value-added in high-tech industries “has been growing at a faster rate than that of domestic high-tech industries for the past seven years.”[i]

The NH High Tech Council asserts[ii] the important contributions of the New Hampshire high-tech sector to the state’s economy, with “nearly $3 billion to the state’s GDP in salaries alone due to the higher than average pay in the sector.” The Council quotes the NH Center for Public Policy, which states that “advanced manufacturing and high technology businesses are the leading drivers of New Hampshire’s economy. Jobs in this sector pay higher wages and export products from the state to other areas of the nation and the world, effectively transferring outside money into the state’s economy. For these reasons, this sector is the strongest engine of economic activity in New Hampshire.” A survey described by the NH High Tech Council, finds that the Northeast is a strong location for high tech startups. New Hampshire does not rank as highly but is an attractive investment location due to the quality of life and the entrepreneurship/innovation ecosystem, which are both above national levels.

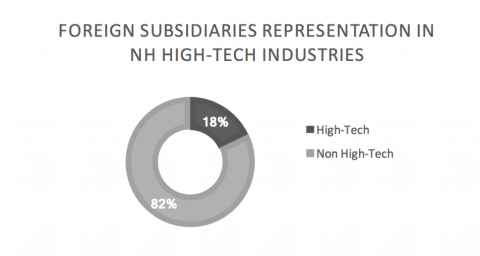

The growth expectation for NH in the tech sector is 6% over the next five years. The NH High Tech Council expects near term growth to come particularly from software and application development, advanced manufacturing, energy technology/clean-tech and cybersecurity. There are opportunities to attract more foreign firms to these industries and to the high-tech sector in general. The present study finds that just under 20% of foreign subsidiaries in New Hampshire are in high-tech industries[iii].

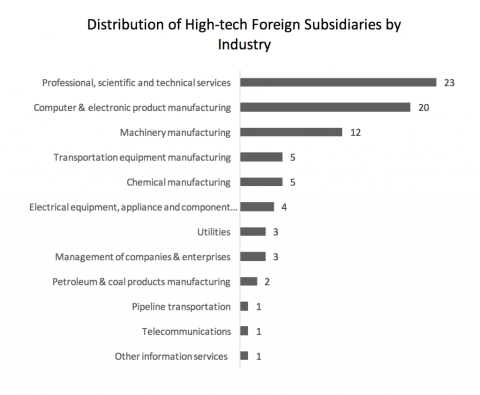

Currently, most high-tech foreign investment as subsidiary operation occurs in professional, scientific and technical services. The industry distribution presented below uses the SelectUSA definition and methodology of the high-tech sector[iv]. SelectUSA noted that the professional, scientific and technical services industry is large in the US, with millions of jobs supported by this industry in STEM[v] and other occupations. By this cataloging of high-tech industries, manufacturing follows the top ranking services as number of foreign firms. This distribution may indicate that the New Hampshire foreign high-tech firms are poised for growth.

The number of employees in the NH high-tech sector is 9% above the national average. The NH High Tech Council observes that NH high-tech companies typically are smaller in size, with 61% under 50 employees compared to 46% nationally. In our reduced sample for which employment data were found (as described in other sections of this report), about 67% of high-tech foreign firms have fewer than 50 employees.

Distribution by Size of Foreign Firms in High-Tech Industries

| Firm size class | Percentage of Companies in Each Firm Size Class: High-Tech Foreign Subsidiaries Only |

|---|---|

| Size class 1 (1 to 4 employees) | 30% |

| Size class 2 (5 to 9 employees) | 11% |

| Size class 3 (10 to 19 employees) | 9% |

| Size class 4 (20 to 49 employees) | 17% |

| Size class 5 (50 to 99 employees) | 17% |

| Size class 6 (100 to 249 employees) | 6% |

| Size class 7 (250 to 499 employees) | 6% |

| Size class 8 (500 to 999 employees) | 4% |

| Size class 9 (1,000 or more employees) | 0% |

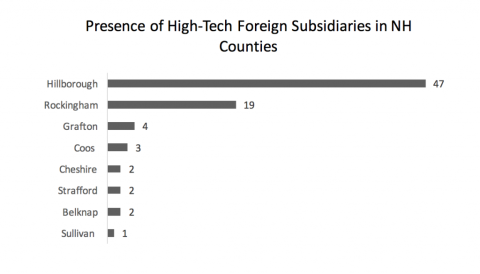

The presence of high-tech foreign subsidiaries across counties identifies the same two top ranking counties as for the overall distribution of foreign subsidiaries in New Hampshire. Hillsborough County has more than double the number of firms as Rockingham County. The remaining counties each have low numbers of high-tech foreign subsidiaries.

The distribution of high-tech foreign firms in Hillsborough County identifies the relative strong representation in the professional, scientific and technical services, and in the computer and electronic product manufacturing. Foreign subsidiaries in machinery manufacturing complete the top 3 high-tech industries by foreign firms’ presence. Rockingham County has the same top 3 industries, with the computer and electronic product manufacturing ranking first.

In Grafton County, there are three high-tech firms in professional, scientific and technical services, and one high-tech firm in machinery manufacturing. In Strafford County, only one high-tech foreign firm operates in each of the industries of chemical manufacturing and transportation equipment manufacturing. In Cheshire County, one high-tech foreign firm operates in each of the industries of chemical manufacturing, and management of companies and enterprises. Sullivan County has one high-tech foreign subsidiary in transportation equipment manufacturing. In Coos County, there are two high-tech firms in utilities and one high-tech firm in chemical manufacturing. Our sample has no high-tech foreign firms in Merrimack and Carroll counties.

The New Hampshire Employment Security uses a different, sub-industry classification of the high-tech sector[vi] (the definition was created by the Bureau of Labor Statistics). This cataloging of high-tech industries shows the importance of professional and commercial equipment and supplies, merchant wholesalers in the state (9 firms). Foreign wholesalers’ presence may indicate opportunities for attracting international manufacturing that would benefit from distribution networks of foreign firms. The architectural, engineering, and related services, and the navigational, measuring, electro-medical, control instrument manufacturing sub-industries share the top rank with supplies/merchant wholesalers sub-industry, followed in numbers (8 firms) by semiconductor and other electronic component manufacturing. This categorization of high-tech shows the level of diversity across sub-industries. About half of the high-tech sub-industries defined by the Bureau of Labor Statistics have foreign firms in New Hampshire.

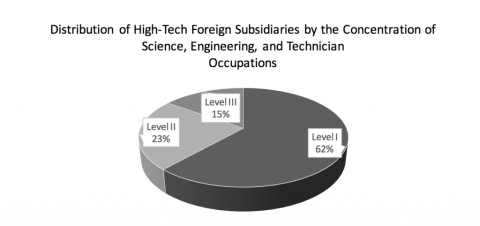

Data reported by the New Hampshire Employment Security, shows yearly increases in New Hampshire high-tech employment and wages over the 2000 ‐ 2016 period[vii]. Using the definition of high-tech employment from the Bureau of Labor Statistics, high-tech industries are those with high concentrations of science, engineering, and technician occupations, and are broken down into three levels[viii]. The distribution of New Hampshire foreign high-tech firms across the three levels shows that most of the high-tech foreign firms are in industries with the highest concentration of science, engineering, and technician occupations of all high-tech industries.

Foreign Firms Representation by Concentration of Science, Engineering, and Technician Occupations

| Level I: industries with a concentration of science, engineering, and technician occupations that was at least 5.0 times greater than the average for all industries. | 45 |

| Level II: industries with a concentration of science, engineering, and technician occupations that was 3.0 to 4.9 times the average for all industries. | 17 |

| Level III: industries with a concentration of science, engineering, and technician occupations that was 2.0 to 2.9 times the average for all industries. | 11 |

According to SelectUSA, “best-in-class global firms investing in innovative U.S. economic sectors ensures the United States retains its global competitiveness in these industries.”[ix] New Hampshire stands to gain from continuing to attract foreign firms as an important way to grow high-tech industries. In addition to supporting employment in advanced industries, foreign subsidiaries make contributions to the economy through research and development, spending, exports, and value-added activities. SelectUSA described an increase in each of these contributions from high-tech foreign subsidiaries at the national level in the past years.

Two related new developments are likely to bring immediate new opportunities and to attract more foreign firms in New Hampshire’s healthcare and life sciences sector[x]. The BioTech/MedTech Cluster, an initiative of the New Hampshire High Tech Council aims to advance the state’s leadership in the biotechnology, pharma, medical devices and general health technology areas. The Advanced Regenerative Manufacturing Institute (ARMI) will open up many opportunities for domestic and foreign firms to partner in the advancement of regenerative manufacturing.

Endnotes

[i] SelectUSA, High-Tech Industries, The Role of FDI in Driving Innovation and Growth, 2017. https://www.selectusa.gov/servlet/servlet.FileDownload?file=015t0000000U1eE.

[ii] NH Tech Council, The NH Tech Sector, https://nhhtc.org/about/the-nh-tech-sector/.

[iii] Using the SelectUSA definition, as described in The Role of FDI in Driving Innovation and Growth, 2017. https://www.selectusa.gov/servlet/servlet.FileDownload?file=015t0000000U1eE.

[iv] In order to analyze FDI in the high-tech sector using data published by the Bureau of Economic Analysis (BEA), SelectUSA created a 3-digit NAICS methodology, identified in the report The Role of FDI in Driving Innovation and Growth, 2017, at https://www.selectusa.gov/servlet/servlet.FileDownload?file=015t0000000U1eE.

[v] Science, technology, engineering, and mathematics (STEM) occupations are analyzed by the Bureau of Labor Statistics. A recent update is included in the January, 2017 report, STEM Occupations: Past, Present, and Future, available at https://www.bls.gov/spotlight/2017/science-technology-engineering-and-mathematics-stem-occupations-past-present-and-future/home.htm.

[vi] The NHES high-tech industry cataloging is at the 4-digit level of The North American Industry Classification System (NAICS) codes, as described at https://www.nhes.nh.gov/elmi/statistics/documents/high-tech-titles.pdf (from Hecker, D., High-technology employment: a NAICS-based update. Monthly Labor Review. July 2005. Bureau of Labor Statistics. www.bls.gov/opub/mlr/2005/07/art6full.pdf).

[vii] New Hampshire Employment Security, High Tech Employment and Wages, 2000 ‐ 2016, https://www.nhes.nh.gov/elmi/statistics/documents/high-tech-00-16.pdf.

[viii] New Hampshire Employment Security, High Tech Employment in New Hampshire 2010, https://www.nhes.nh.gov/elmi/products/documents/ec-high-tech-10.pdf.

[ix]Idem i.

[x] NH Tech Council, NH High Tech Council BioTech/MedTech Event to Take Regional View of Regenerative Medicine, December 21, 2017. https://nhhtc.org/nh-high-tech-council-biotechmedtech-event-to-take-regional-view-of-regenerative-medicine/.