Europe, Canada and East Asia Drive the Foreign Direct Investment in New Hampshire

According to the sample used for this analysis, as of 2017 the State of New Hampshire has a total of 453 subsidiaries owned by 186 foreign parent companies from 24 overseas countries. The FDI Origin Index is constructed to measure and compare the level of desire for parent companies in different origins to invest in New Hampshire.[i] This index provides useful information for the state policy-makers and Economic Development Agencies (EDA) in regards to strategically allocating their resources in attracting FDI from various countries of origin.

Mapping the countries of origin for foreign subsidiaries in New Hampshire reveals a dominating desire to invest in New Hampshire from European countries, with other origins (by investment desire) scattering in North America, East Asia and Australia. The table included below ranks all countries of origin by the FDI Origin Index. Parent companies in Germany lead all other countries in terms of the likelihood to have subsidiaries in New Hampshire, followed by America’s northern neighbor, Canada. Japan is the only Asian country among the Top 10 countries that have the highest probability to have subsidiaries in New Hampshire.

Countries of Origin for Foreign Subsidiaries in New Hampshire

Ranking of Companies’ Countries-Of-Origin by Level of Desire to Invest In New Hampshire

| Country of Origin | FDI Origin Index |

|---|---|

| Germany | 674.9 |

| Canada | 276.4 |

| Switzerland | 256.4 |

| France | 231.5 |

| Italy | 200 |

| Netherlands | 173.7 |

| Sweden | 169.4 |

| Norway | 133.3 |

| Japan | 121.8 |

| Ireland | 114.1 |

| Jersey | 100 |

| United Kingdom | 71.5 |

| Israel | 52.5 |

| Austria | 41.2 |

| China | 41 |

| Netherlands Antilles | 40 |

| Korea, Republic of | 16.7 |

| Bermuda | 13.3 |

| Belgium | 9.3 |

| Australia | 7.4 |

| Spain | 7 |

| Denmark | 3.2 |

| Finland | 2 |

| Luxembourg | 0.2 |

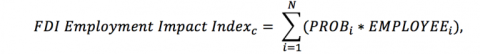

Among the most important contributions that inward FDI adds to local economies in New Hampshire are job creation and retention. The FDI Employment Impact Index is constructed to indicate the estimated employment in New Hampshire that could potentially be supported by parent companies headquartered in each of the 24 countries of origin.[ii]

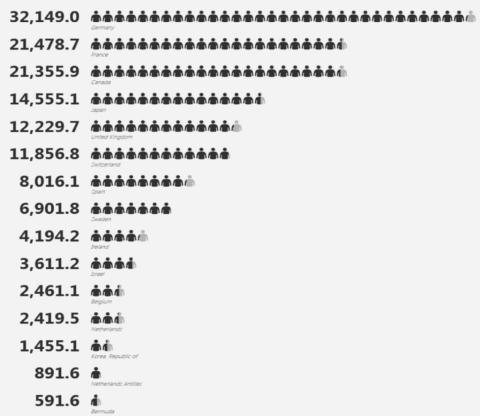

Our analysis ranks the countries of origin according to the FDI Employment Impact Index for the 15 leading overseas countries.[iii] Germany ranks Number 1 with the estimated 32,149 potential jobs in New Hampshire, followed by France and Canada, each with a potential to support over 21,000 New Hampshire workers. In addition to Europe and Canada, East Asia is also an important employment engine mainly because Japan (and Korea) is ranked Top 4 (and Top 13) on this list. In total, the two Asian countries could potentially support around 16,000 New Hampshire workers.

FDI Employment Index for the Top 15 Country of Origin

The inward FDI also contributes to the Gross State Products (GSP) of New Hampshire. This contribution is realized through the revenues of foreign subsidiaries. The GSP Impact Index is computed to indicate the estimated GSP in New Hampshire that could be potentially realized by foreign subsidiaries headquartered in a foreign country.[iv]

The ensuing figure illustrates the estimated GSP impact (in $million) on the New Hampshire economy of FDI for the Top 15 countries of origin.[v] Germany and Canada are ranked as Number 1 and Number 2, respectively. They significantly outperform France, Japan and United Kingdom who are also ranked Top 5 in the list of GSP Impact Index. Korea is the other Asian country among Top 10 while the predominance of European countries is not surprising.

FDI GSP Index for the Top 15 Country of Origin

Endnotes

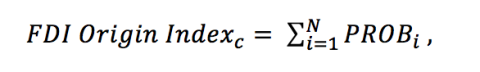

[i] FDI Origin Index is constructed for a foreign country c in the following way:

where N is the number of parent companies from country c with at least one subsidiary in New Hampshire. The probability for a foreign parent company i to have at least one subsidiary in New Hampshire is conditional on the following criteria being satisfied: (1) this foreign company has operations in overseas countries, (2) among all the foreign subsidiaries at least one is located in the US, and (3) at least one of the foreign subsidiaries located in the US is in New Hampshire. Therefore, the conditional probability is defined as:

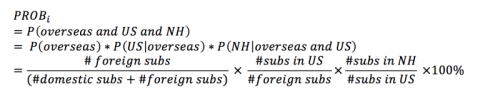

[ii] FDI Employment Impact Index for a foreign country c:

where EMPLOYEEi is the total number of employees (including those in subsidiaries) of a foreign parent company i, and in country c there is a total of N parent companies that each has at least one subsidiary in New Hampshire.

[iii] FDI Employment Impact Index for other countries of origin is shown in the following table.

| Country of Origin | FDI Employment Impact Index |

|---|---|

| Norway | 550 |

| Italy | 470 |

| Jersey | 450 |

| Austria | 441.4 |

| China | 225.6 |

| Denmark | 219.5 |

| Finland | 159.1 |

| Australia | 70.9 |

| Luxembourg | 18.3 |

[iv] Because subsidiary-level data on revenue is scarce, the authors used the annual revenue of a parent company i as proxy to calculate the GSP Impact Index for a foreign country c:

where N is the count of parent companies in country c that have operations in New Hampshire.

[v] FDI GSP Impact Index for other countries of origin is shown in the following table.

| Country of Origin | FDI GSP Impact Index |

|---|---|

| Netherlands Antilles | 104.5 |

| Norway | 104 |

| Austria | 93.8 |

| Denmark | 88.7 |

| Finland | 55.4 |

| Jersey | 34.9 |

| China | 16.4 |

| Luxembourg | 5.3 |

| Australia | 4 |