Key Industries and Sectors of New Hampshire Vary in the Composition and Concentration of Countries of Origin for Foreign Direct Investment

Foreign Direct Investment (FDI) participates in all of the three value chain activities, with foreign firms playing important roles of producers, distributors, and service providers, across a variety of industries and sectors of the New Hampshire economy. Not only does the data analyzed in this chapter provide useful information to foreign investors who are looking at New Hampshire as a potential location for investment, it is also informative to Economic Development Agencies (EDA) in strategically attracting FDI and allocating the investment across industries. The importance of this knowledge is highlighted by the findings of academic research that foreign firms tend to geographically cluster around other foreign businesses both within- and across-industries (Rogers and Wu, 2012).[i]

Understanding the sources of FDI along the whole value chain allows potential foreign investors to discover business opportunities with the upper-stream suppliers, partners and the down-stream clients in New Hampshire. In our sample, about 44 percent of all foreign subsidiaries in New Hampshire are service providers, followed by distributors (35 percent) and producers (21 percent).[ii] The figure presented below offers a scrutiny of the countries of origin for foreign subsidiaries in each value chain activity.

The service activity in New Hampshire embraces a total of 201 foreign firms whose parent companies are located in 17 countries. This level of value chain activity is marked by the dominance of FDI from the America’s northern neighbor, Canada, who captures 45 percent of the total count of foreign service providers, a number that almost doubles the share of United Kingdom (27 percent) who is ranked the second. Adding the share of Spain (9.4 percent) who is in the third place, the top three countries of origin account for 81 percent of FDI (by number of foreign subsidiaries) in New Hampshire’s service sectors.

The product distribution activity is not as concentrated as service. It is more evenly spread out among a total of 158 subsidiaries of parent companies headquartered in 16 countries. The 4-country concentration ratio is 54.4 percent, calculated by summing up the shares of the four leading countries of origin, namely Netherlands (15.8 percent), France (15.2 percent), Germany (12.0 percent) and Canada (11.4 percent).[iii] It is worth noting that Japan, ranked the 5th with 11 percent of foreign distributors in New Hampshire, is the only non-European and non-American country.

Multinational manufacturers from 16 countries operate 94 subsidiaries in New Hampshire. Although it is not surprising that Germany leads other countries of origin by capturing 28 percent of the total number of foreign manufacturing firms, it is notable to find that Ireland, which ranks second, has a share that is only half of Germany’s. Japan ranks the third (10.6 percent), followed by France and United Kingdom (8.5 percent for each).

FDI made its appearance in 47 3-digit NAICS code industries across many important aspects of the New Hampshire economy including construction, manufacturing, retail, wholesale, services, lodging and food, etc. The analysis presented here provides a scrutiny of countries of origin for the key industries in which foreign subsidiaries operate. The information is a useful bridge connecting foreign investors who are seeking investment opportunities in New Hampshire with the state agencies who are attracting FDI to promote local economies. This facilitates a win-win situation.

As shown in the figure below, 15 out of 47 3-digit NAICS code industries have 10 or more foreign subsidiaries. Credit intermediation and related activities (NAICS code 522) ranks predominately Number 1 with over a quarter of all foreign subsidiaries. Within this industry, Canada dominates 59 percent of the total count of foreign firms, followed by United Kingdom (25 percent) and Spain (15 percent). Merchant wholesalers durable goods (NAICS code 423) embraces FDI from 12 countries in which France leads this group with a share of near one third, and Switzerland (14 percent), Germany (11 percent) and Japan (11 percent) are other top contributors. The third largest industry (in terms of count of foreign subsidiaries) is professional, scientific and technical services (NAICS code 541), in which FDI from 10 foreign countries operate 25 subsidiaries in New Hampshire. United Kingdom (28 percent), Canada (20 percent) and Germany (16 percent) lead other countries of origin in this industry. Food and beverage stores (NAICS code 445) ranks the fourth and captures 5 percent of all foreign subsidiaries. FDI in this industry are from only four European countries, namely Netherlands (45 percent), Switzerland (36 percent), Germany and United Kingdom (9 percent each). The fifth largest industry is clothing and clothing accessories stores (NAICS code 448), in which Bermuda (43 percent), Canada (24 percent) and Netherlands (14 percent) are the 3 (out of 7) leading countries of origin.

The majority of industries with FDI in New Hampshire (32 out of 47) each has less than 10 foreign subsidiaries, and in total these industries share near 20 percent of all foreign subsidiaries. It is worth noting that the top contributing countries of origin in these less represented industries are Canada and Japan, whose multinationals operate 17 and 15 subsidiaries in 11 and 5 (out of 32) New Hampshire industries, respectively. Other important FDI countries of origin include France (9 subsidiaries in 7 industries) and Germany (9 subsidiaries in 4 industries). More detailed information is outlined in the following figure.

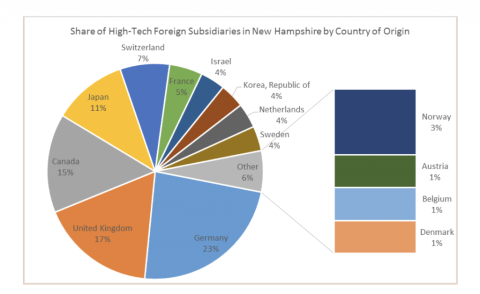

FDI brings cutting edge technology and know-how to their subsidiaries in a foreign country, and thus benefits the local economy via training local workers and the technology spillovers to domestic firms (Wu and Burge, 2017).[iv] As for the state of New Hampshire, 18 percent of all foreign subsidiaries are in the high-tech industries.[v] Europe is the predominant driving power for high-tech FDI in New Hampshire, and East Asia is the other important source. Specifically, two European countries, Germany and United Kingdom, contribute 40 percent of high-tech foreign subsidiaries in combination. Canada ranks the third with 15 percent of the count of foreign firms, signifying a notable border effect. Japan captures 11 percent of this pie and is the fourth largest contributor.

To better reflect on the presence of FDI across sections of New Hampshire economy, the authors further integrate the 47 3-digit NAICS code industries where foreign firms operate into 20 sectors based on the markets of product and service. About two thirds of the 20 sectors embraces 10 or more foreign subsidiaries. The fact that FDI makes its appearance in the most sectors reveals its importance to the production and distribution across a vast range of product and service markets of New Hampshire.

Banking and financial services is identified as the largest sector in terms of capturing 28 percent of the total number of foreign subsidiaries. This sector has FDI from only 5 countries and is concentrated among Canadian (58 percent), British (25 percent) and Spanish (15 percent) financial institutions. The sector of computer, electronic, electrical, and communication equipment and instruments ranks the second with a share (12 percent) that is less than half of the Number 1 sector. However, this sector is the most international with FDI from 13 countries across Pacific-Asia, Europe and North America. Germany (36 percent), France (21 percent) and United Kingdom (14 percent) lead other countries of origin in this sector. The sector of textiles, clothing, footware and accessories, and the sector of professional services both rank in the third place, each capturing 7 percent of the total count of foreign subsidiaries in New Hampshire. In the former sector, Bermuda (28 percent) and Canada (16 percent) lead the all 12 countries, while United Kingdom (22 percent) and Canada (19 percent) lead the all 10 countries of origin in the latter sector.

Endnotes

[i] Rogers, C. and C. Wu. 2012. Employment by Foreign Firms in the US: Do State Incentives Matter? Regional Science and Urban Economics 42(4): 664-680.

[ii] The sample for the analysis presented in the three chapters of origin analysis contains a total of 453 foreign subsidiaries. This varies slightly from the foreign subsidiaries’ sample which contains 447 subsidiaries in other parts of the report, as more data was collected for the purpose of origin investigation.

[iii] The Four-Firm Concentration Ratio is the sum of the sales’ share of the leading four firms in a market. A large ratio indicates a high level of concentration in the market under study. Here, the authors borrowed this ratio to measure the level of concentration of foreign subsidiaries in terms of their origin.

[i] Wu, C. and G. Burge. 2017. Competing for Foreign Direct Investment: The Case of Local Governments in China. article first published online (March 2017) at Public Finance Review.

[v] Industries for this analysis were based on SelectUSA’s identification of high-tech industries at the 3-digit level of The North American Industry Classification System (NAICS).