Distribution of Countries of Origin for Foreign Direct Investment across Counties Reveals Geographic Agglomeration of Foreign Firms in New Hampshire

Foreign direct investment (FDI) takes place in all of the 10 counties of New Hampshire[i]. The level of FDI presence in terms of the count of foreign subsidiaries, however, significantly varies, with a decreasing pattern from north to south, and from east to west. The two southernmost counties, Hillsborough and Rockingham, predominately outperform all other counties by capturing 41 percent and 25 percent of the total number of foreign subsidiaries, respectively. The three inner counties, namely Merrimack, Grafton and Belknap, follow their southern counterparts in the rank and, in total, the three counties share 19 percent of all foreign firms in New Hampshire. The northeastern (Coos and Carroll) and the southwestern (Cheshire and Sullivan) parts of New Hampshire are the least represented by FDI, having 5 percent and 6 percent of state’s foreign subsidiaries.

The distribution pattern of FDI across counties reveals a notable geographic cluster of foreign firms in the Nashua-Manchester-Portsmouth economic delta along the New Hampshire-Massachusetts border (centered on Boston) and agglomeration spillover towards the inner center of the state. The policy implication of this finding highlights coordinating FDI promotion policy across counties to increase the overall pool of FDI in the state, rather than encouraging local competition over a largely fixed pool of aggregate FDI (Wu and Burge, 2017).[ii] Efforts to attract new FDI might give priority to locating them in the southern region where the FDI cluster is prevailing and facilitate spillovers of foreign investment from the south to the north.

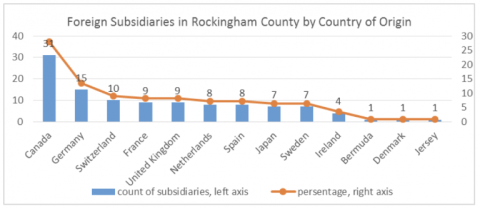

Hillsborough County attracts FDI from 21 countries in Europe, East Asia, Middle East and Australia. The leading countries of origin for FDI in this county (and their share) are Canada (22 percent), United Kingdom (17 percent), Germany (11 percent) and Japan (9 percent). Rockingham County has a smaller number of countries of FDI origin (13 countries) than Hillsborough, and its top 5 FDI sources (Germany, 14 percent; Switzerland, 9 percent; France, 8 percent; United Kingdom, 8 percent) are all European countries except for Canada (28 percent).

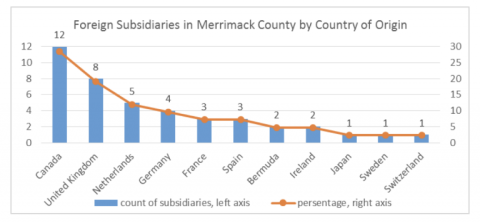

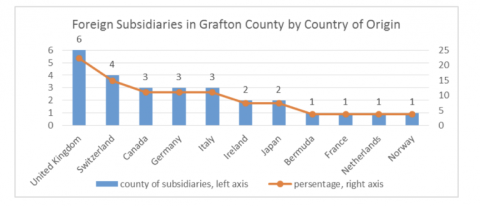

The adjacent Merrimack Country and Grafton Country are in the geographic center of the state and both contain FDI from 11 foreign countries. The composition and distribution of foreign subsidiaries among the origins is similar between the two counties, but in the former county the top 3 countries of origin are Canada (29 percent), United Kingdom (19 percent) and Netherlands (12 percent), while in the latter county they are United Kingdom (22 percent), Switzerland (15 percent) and Canada (11 percent).

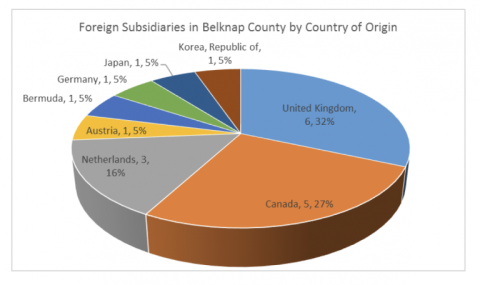

Belknap County and Strafford County both have 19 foreign subsidiaries whose parent companies are located in 8 countries. United Kingdom (32 percent), Canada (26 percent) and Netherlands (16 percent) lead other 5 countries (including two East Asian countries, Japan and Korea) in Belknap, while Canada (26 percent), Germany (21 percent) and France (16 percent) lead the other 5 (including one East Asian country, China) in Strafford.

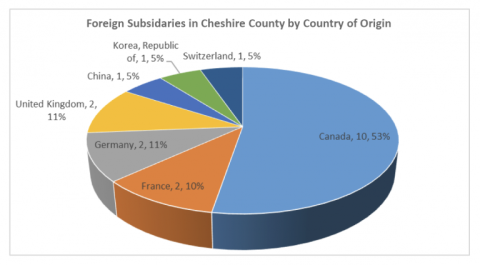

Cheshire County’s FDI are predominately from America’s northern neighbor, Canada, who individually accounts for over half of all total foreign subsidiaries. It is worth noting that, Chinese and Korean multinationals also operate subsidiaries in this county. In comparison, countries of origin for foreign firms in Carroll County are more evenly distributed among Canada and other 5 European countries.

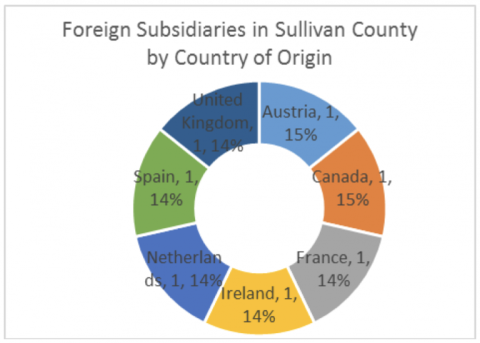

Coos County and Sullivan County both have less than 10 foreign subsidiaries. The former has FDI from two leading countries of origin, namely Canada (37.5 percent) and United Kingdom (25 percent), as well as Japan. In the least FDI-represented county, Sullivan, FDI origins are evenly shared by Canada and 6 other European countries.

Endnotes

[i] The sample for the analysis presented in the three chapters of origin analysis contains a total of 453 foreign subsidiaries. This varies slightly from the foreign subsidiaries’ sample which contains 447 subsidiaries in other parts of the report, as more data was collected for the purpose of origin investigation.

[ii] Wu, C. and G. Burge. 2017. Competing for Foreign Direct Investment: The Case of Local Governments in China. Article first published online (March 2017) at Public Finance Review.